Investment Rush: New Trends in Japan’s Real Estate Market

In addition to luxury shopping, the depreciation of the yen has also attracted a large number of international investors to pay attention to the Japanese real estate market. Jiang Peng (pseudonym), who works in Osaka, plans to exchange his RMB for Japanese yen and purchase properties in the suburbs of Osaka as an investment. It is reported that in the past two years, housing prices in Japan have risen significantly, with Tokyo rising by 30% and Osaka rising by 15%. However, Xue Pingyuan, president of the Japan Overseas Chinese Women’s Federation, reminded that at present, Japan’s housing prices have risen more, and have returned to the peak of the foam in the 1990s. Overseas investors need to be cautious.

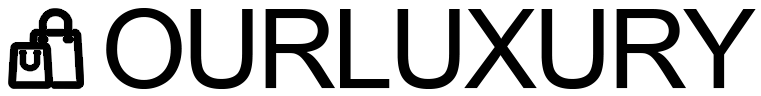

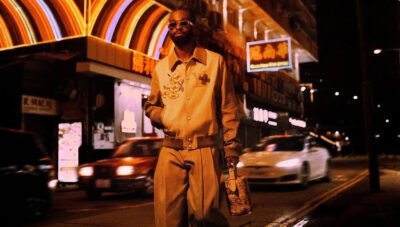

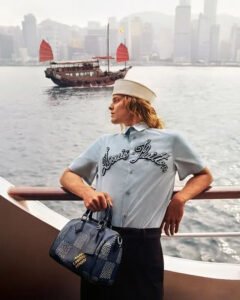

The surge of Chinese tourists to luxury stores in Japan

According to reports, Chinese tourists can be seen everywhere in luxury stores in Kyoto and other places in Japan. Due to the depreciation of the Japanese yen, many luxury goods purchased in Japan are nearly 10% to 50% cheaper than those purchased domestically. For example, a tourist named Ula observed that a bag worth 20000 yuan can be purchased in Japan for a discount of 3000 to 4000 yuan. Furthermore, some tourists were carrying two 28 inch suitcases to Japan, preparing for a massive sweep of goods.

The Japanese yen exchange rate has plummeted, leading to a shopping boom in Japan

Recently, the significant decline in the Japanese yen exchange rate has become a hot topic in the international financial market. Since April 10th, the exchange rate of the Japanese yen against the US dollar has depreciated to 154.33 yen per dollar, and the exchange rate against the Chinese yuan has also hit a new low in recent years. As of 12:00 on April 20th, 100 yen can be exchanged for 4.7 yuan. This change directly led to an unprecedented wave of Chinese tourists shopping in Japanese luxury stores.